Contracts for Big difference (CFDs) have grown to be a favorite technique for effective traders seeking to capitalize on market movements without buying the underlying assets. That innovative economic solution offers special benefits for those seeking to diversify their expense portfolios or manage dangers effectively. But what exactly is cfd trading, and how could it function to your gain? Here's all you need to know.

What Is CFD Trading?

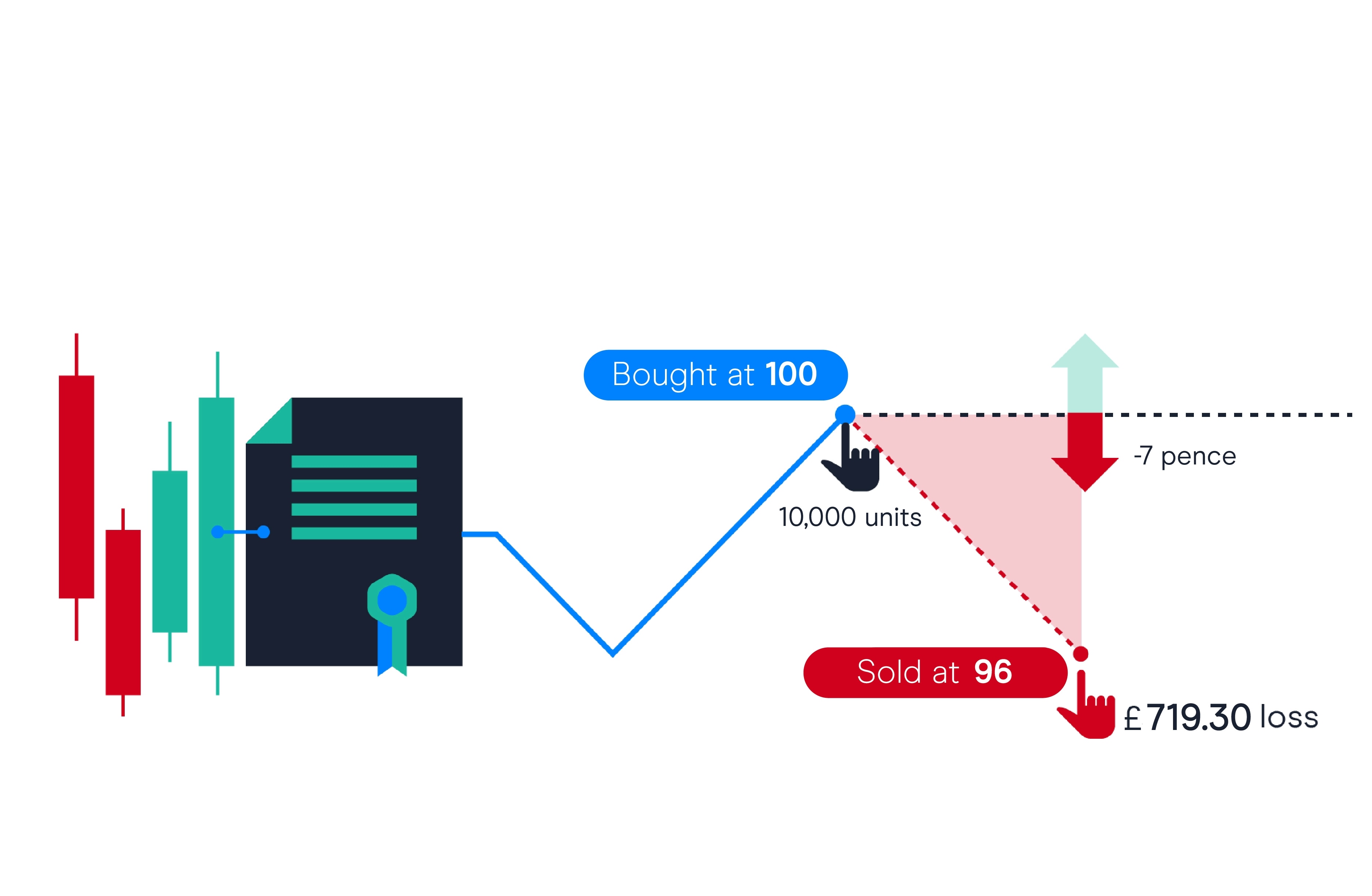

Simply put, CFD trading allows you to imagine on the purchase price changes of varied resources, including stocks, currencies, commodities, and indices, without really buying them. A CFD is a contract between a trader and a broker, wherever profits or deficits are established by the big difference between the starting and ending cost of an asset.

One of many standout options that come with CFD trading is leverage. This enables traders to start greater jobs with a smaller transparent expense, magnifying potential profits—but additionally increasing risks.

Great things about CFD Trading for Your Account

CFDs offer a few advantages that could support increase a well-rounded expense profile:

1. Usage of Global Areas

CFDs give traders use of a broad selection of markets across the globe. From commodities like silver and oil to indices in Europe or Asia, CFD trading extends your achieve beyond domestic assets, permitting international diversification.

2. Short and Extended Positions

Unlike traditional advantage trading, CFDs permit you to make money from equally increasing and slipping markets. By going for a extended position, you can take advantage of cost raises, while short positions help you to revenue if rates fall. This freedom can act as a hedge against potential deficits in your present portfolio.

3. Leverage for Larger Opportunity

Leverage lets you get a handle on bigger trades with a smaller money outlay. For example, with a 5% margin requirement, you might start a $10,000 place with just $500. While this may improve earnings, traders must be cautious, since it also magnifies losses.

4. Number Control Prices

CFDs remove expenses connected with possessing physical assets, such as for example storage, preservation, or press duties. That streamlined method can increase cost-efficiency, specifically for effective traders.

5. Sophisticated Chance Administration Tools

Most brokers offer risk management methods like stop-loss and take-profit purchases, ensuring as you are able to effectively control potential deficits and lock in gets based on your financial goals.

Final Feelings

CFD trading, when approached with persistence and a solid risk management strategy, presents unparalleled freedom and usage of worldwide markets. Whilst it may considerably enhance your collection, remember that power and market volatility need cautious decision-making.

Enthusiastic about exploring CFD trading? Begin investigating strategies and industry trends to ascertain when it aligns along with your economic objectives.